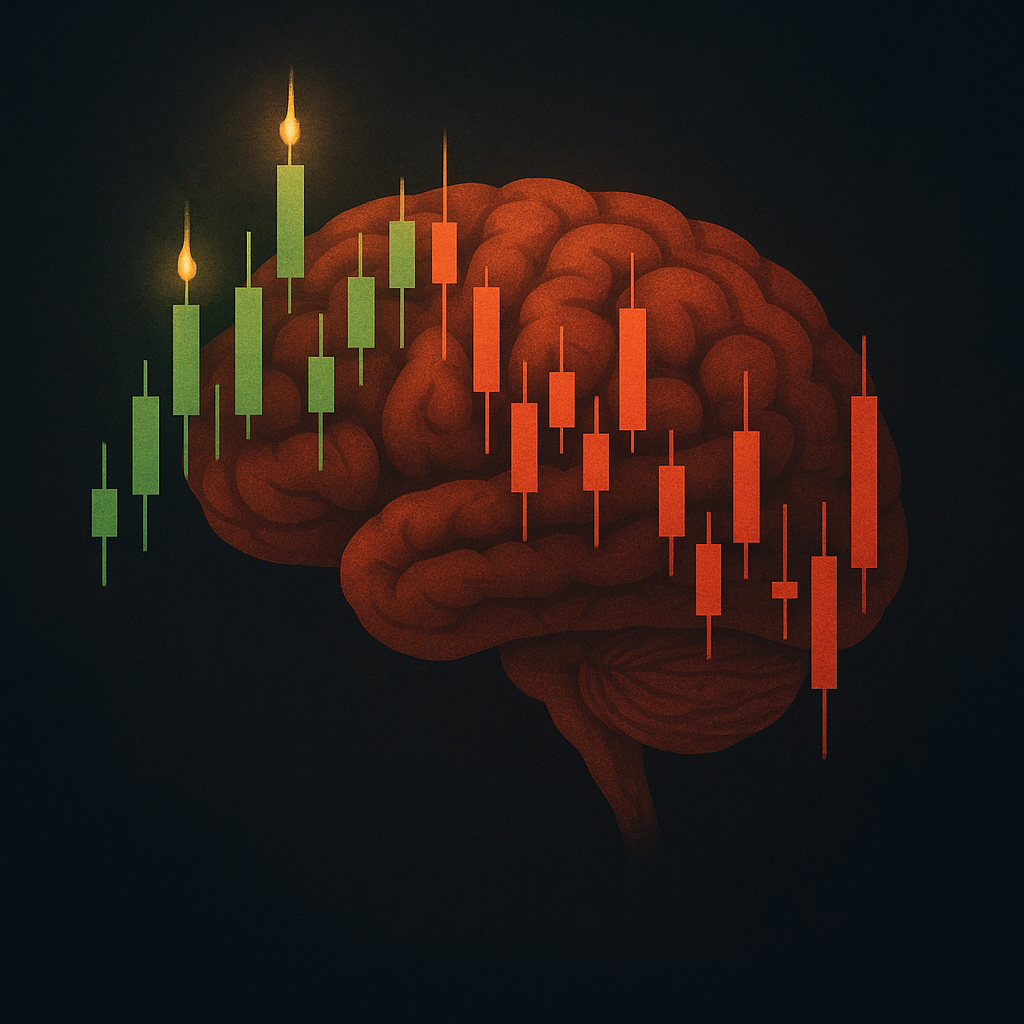

The Candlelight Brain

How traders think under flickering pressure: discipline, heuristics, and decision quality.

Why It Matters

Markets blink in milliseconds; your brain writes stories in milliseconds too. Edge comes from converting stories into rules.

Playbook

- Pre-commit triggers, invalidation, and position size so execution is a lookup, not a debate.

- Score trades on process compliance before P&L.

- Reward the boring: clean entries at planned levels; no improvisation mid-trade.

Metrics to Track

- Process compliance score (0–100)

- Average R per trade and per day

- Max adverse excursion vs. stop distance

- Time-to-recover from peak-to-trough drawdown

Common Traps

- Expanding risk after a win or contracting after a loss without rules

- Overfitting entries to noise on lower timeframes

- Neglecting higher-timeframe regime checks

Checklist (print this)

- Bias and invalidation stated in one sentence.

- Position size derived from distance-to-stop.

- Entry trigger and exit cadence specified.

- Kill-switch conditions defined (session drawdown / error count).

- Post-trade note (2 lines): what was planned, what happened.

Educational content only. Not financial advice.