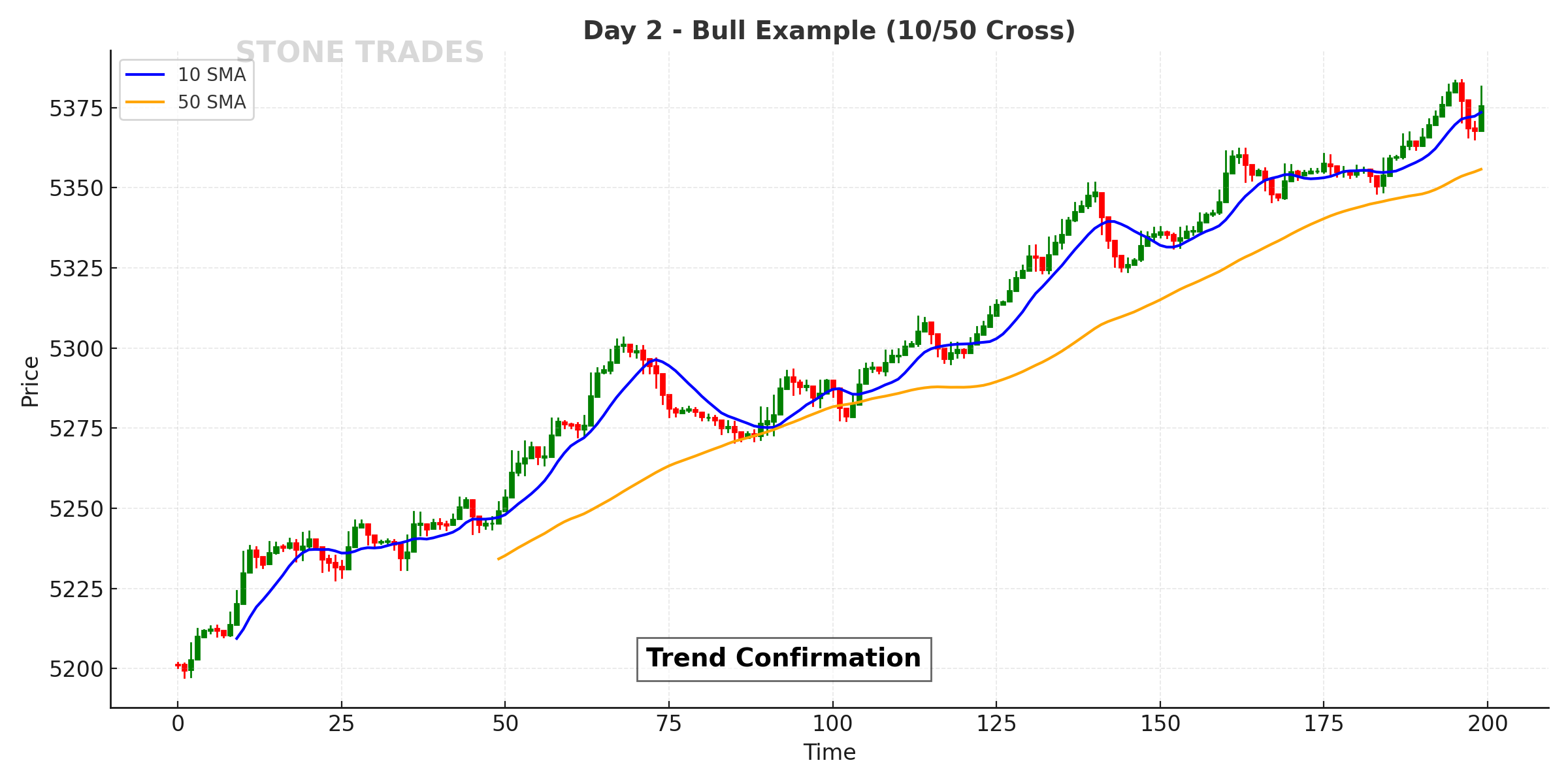

Last week’s $SPX trend was tradable with one signal: the 10/50 cross. Today I’m doubling down on scalability — the part of trading most people skip. The system is simple: SMA(10) and SMA(50) on the 30‑minute chart. When the 10 crosses the 50, I align with it. When it fails, I cut. That’s not magic. It’s process, executed without hesitation.

Why This Works: Simplicity Scales on $SPX

Edge isn’t found in clutter; it’s found in constraints. The 10/50 forces trend alignment on SPX and major indices. With two lines, there’s no room for narrative to creep in and sabotage execution. You either have a valid signal or you don’t. That binary logic steadies your behavior across market regimes.

- Objective Bias: 10 above 50 = long bias; 10 below 50 = short/flat.

- Fast Decisions: Entries on cross or first pullback with risk defined.

- Repeatable Exits: Partial into levels; trail under the 50; exit on opposite cross.

Execution Template

- Wait for a clean cross and one confirming candle (avoid impulsive first ticks).

- Define invalidation at a recent swing or ATR multiple; size = risk / (entry − stop).

- Scale out in thirds at prior structure; trail under the 50; stop trading if daily max loss hits.

Notice what’s missing: prediction. I’m not guessing tops or bottoms; I’m riding the wave the market gives. Surfers don’t create waves—they ride them. Same here: ride the move until the system tells you it’s done.

Psychology: System First, Ego Last

Fear exits too early. Greed enters too late. Ego stays too long. If you don’t build a rule‑set that overrides those impulses, the market will extract tuition until you do. The 10/50 is my throttle and my brake. It gives me permission to act and permission to stop, without negotiating with my emotions.

How to Use Today’s Chart

Scroll the chart at the top of this post. Watch how the 10 crosses the 50 and how price respects the 50 during the trend phase. Note the pullbacks that hold the moving averages and the spots where the opposite cross ends the idea. That is the entire business model: enter, manage, exit—according to rules.

Key Takeaways

- Trade in the direction of the 10/50 cross; don’t fight it.

- Risk small and uniform; winners can breathe, losers stay tiny.

- Journal rule adherence daily; edge shows up over a week, not a trade.

Pro Tips

- Avoid the first 15–30 minutes on directionless opens; let the cross settle.

- On catalyst days (FOMC, earnings), reduce size and demand cleaner confirmation.

- Use alerts on the 10/50 rather than staring—decision fatigue is real.

Get Discounted Apex Trader Funding →

— Stone Trades