The System: S&P 30 Min 10/50 SMA Strategy

Binge the full Stone Trades series— rules, psychology, charts, and execution. Built around the 10/50 SMA on the SPX 30-minute chart.

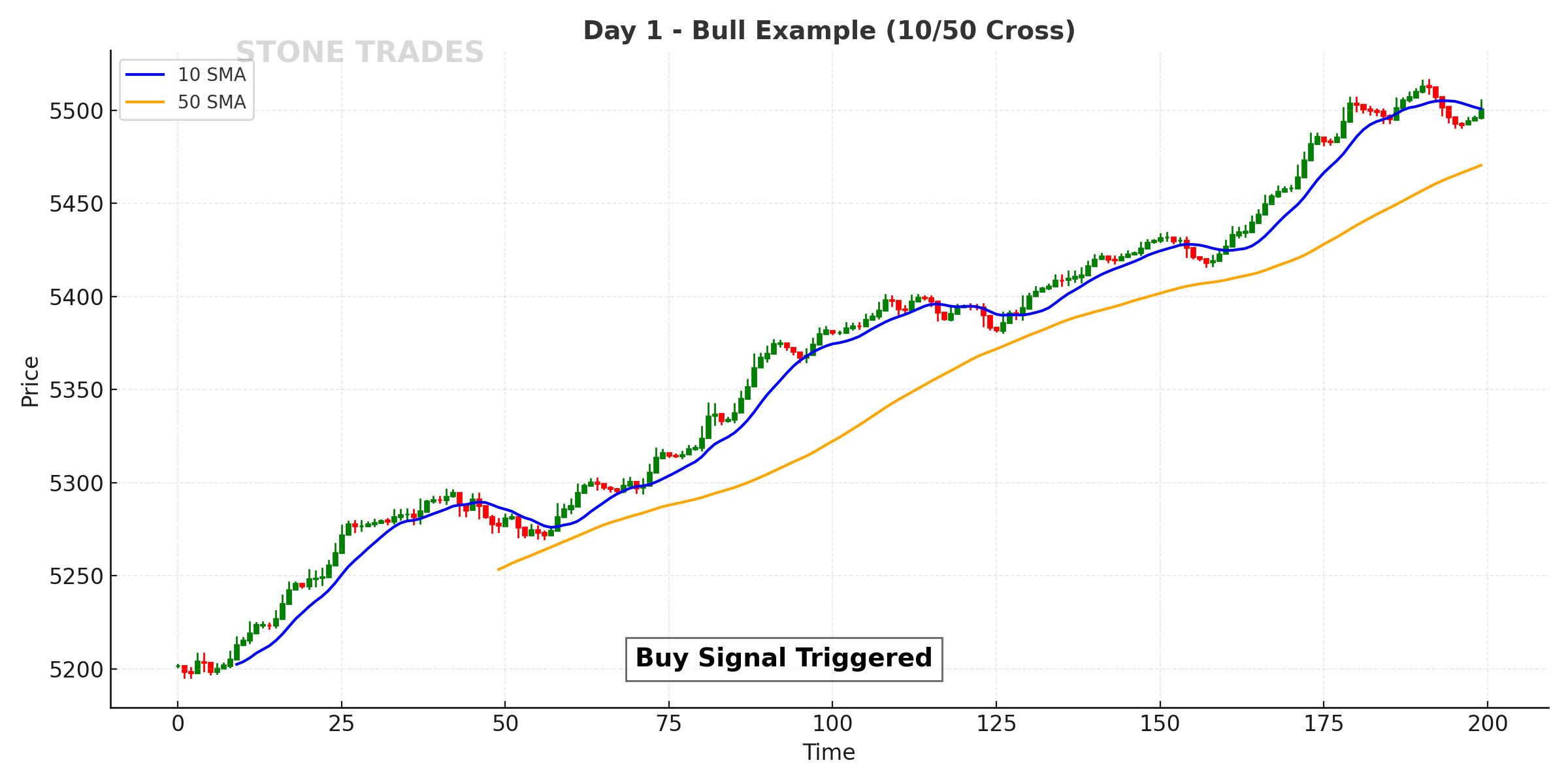

Day 1 – Two Lines Beat Complexity

Two moving averages on a 30-minute chart have made me more consistent than any stack of indicators.

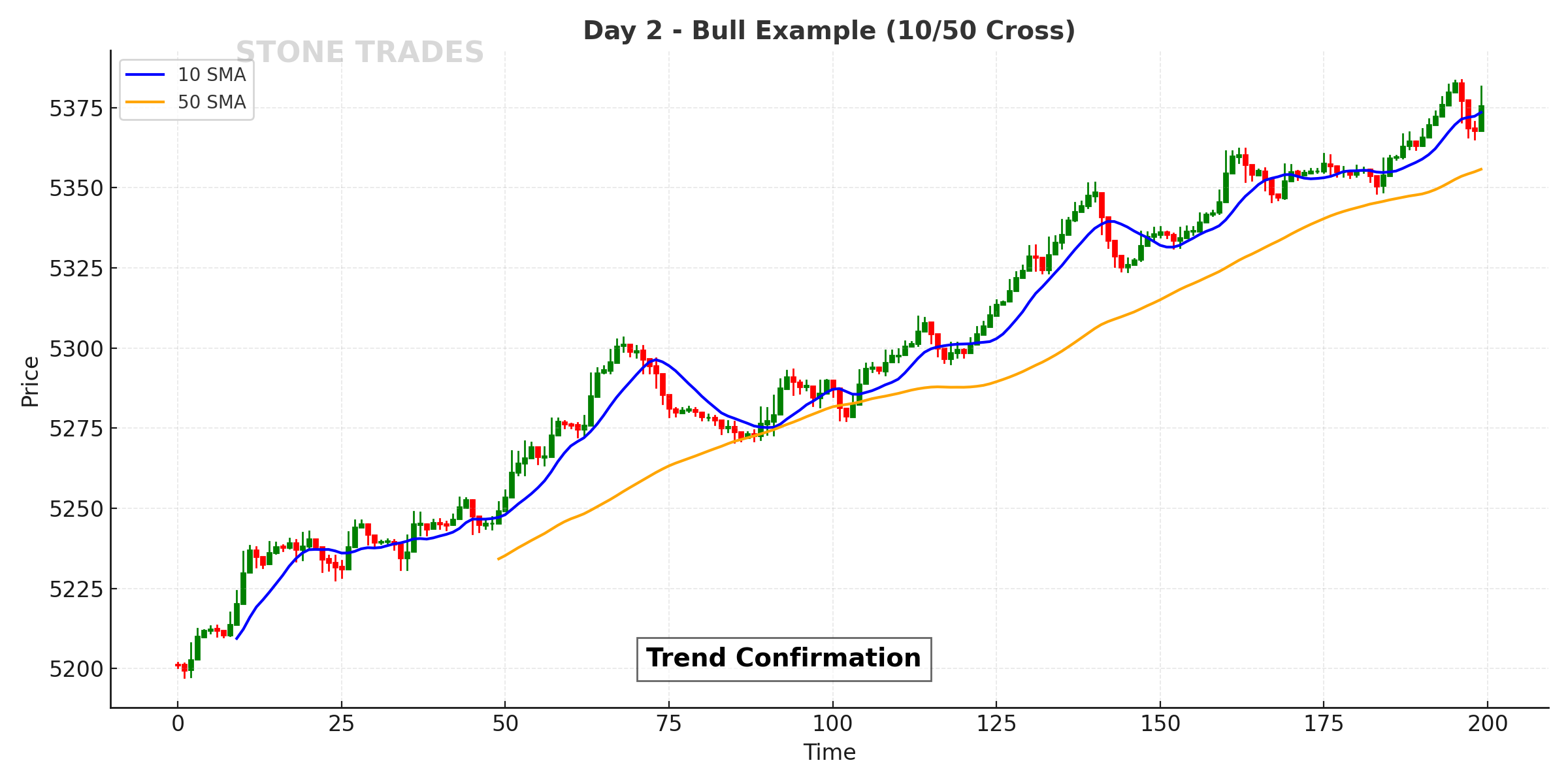

Day 2 – Simplicity Scales on $SPX

Last week’s $SPX trend was tradable with one signal: the 10/50 cross.

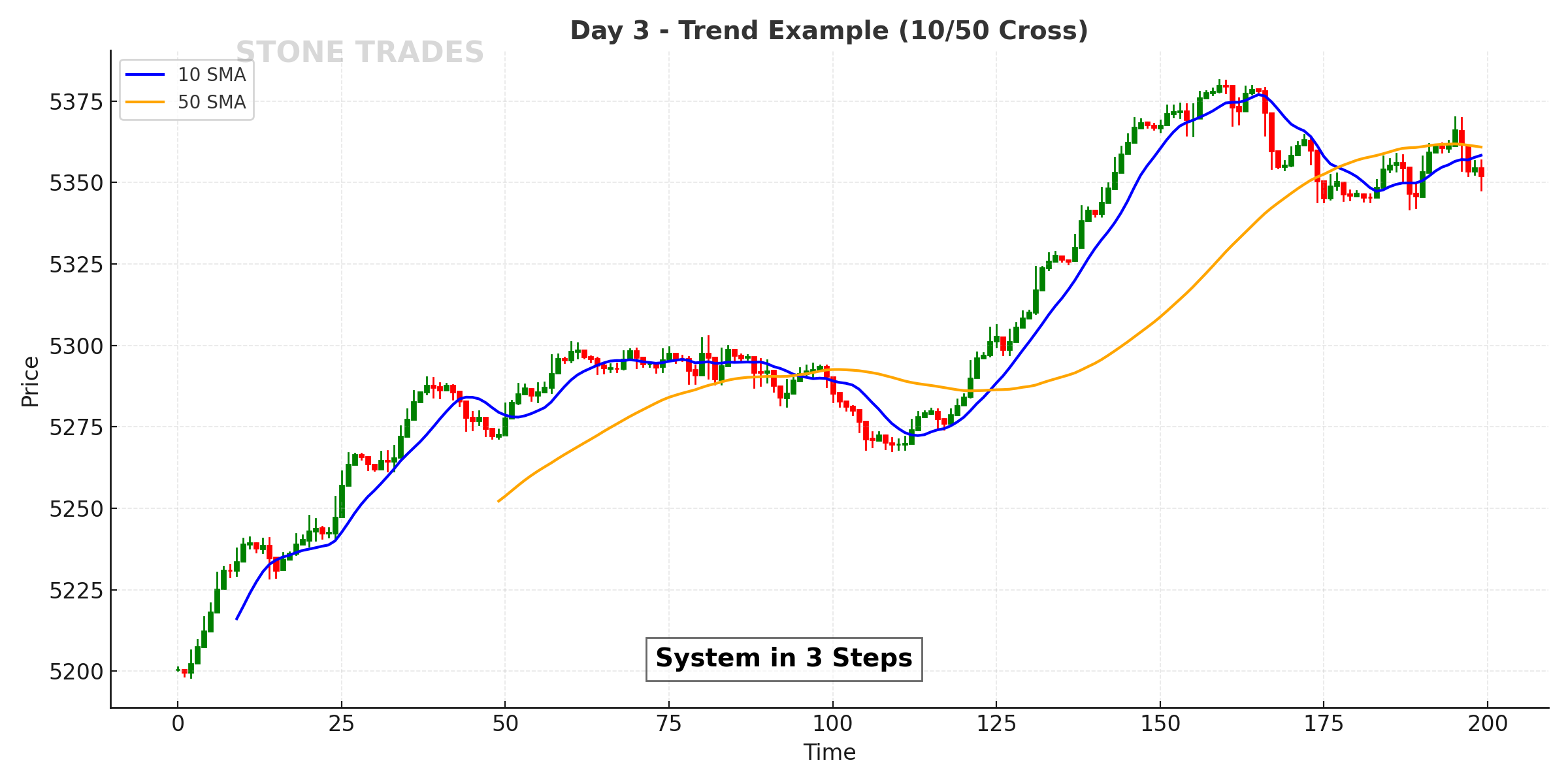

Day 3 – The System in 3 Steps

The 10/50 SMA system fits on a sticky note—and that’s the point.

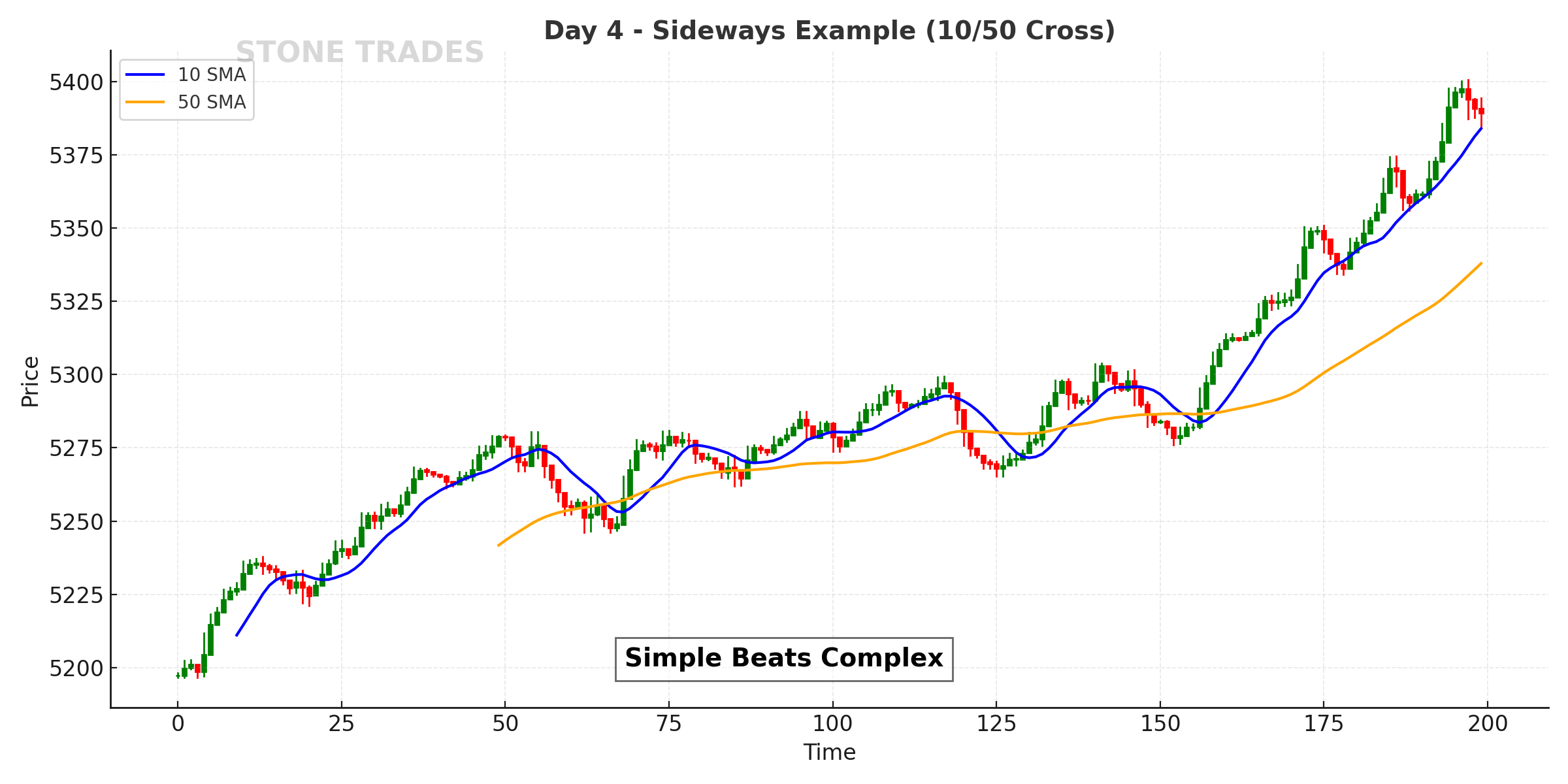

Day 4 – Simple Beats Complex

Indicators pile up. Discipline thins out. Keep the rules tight.

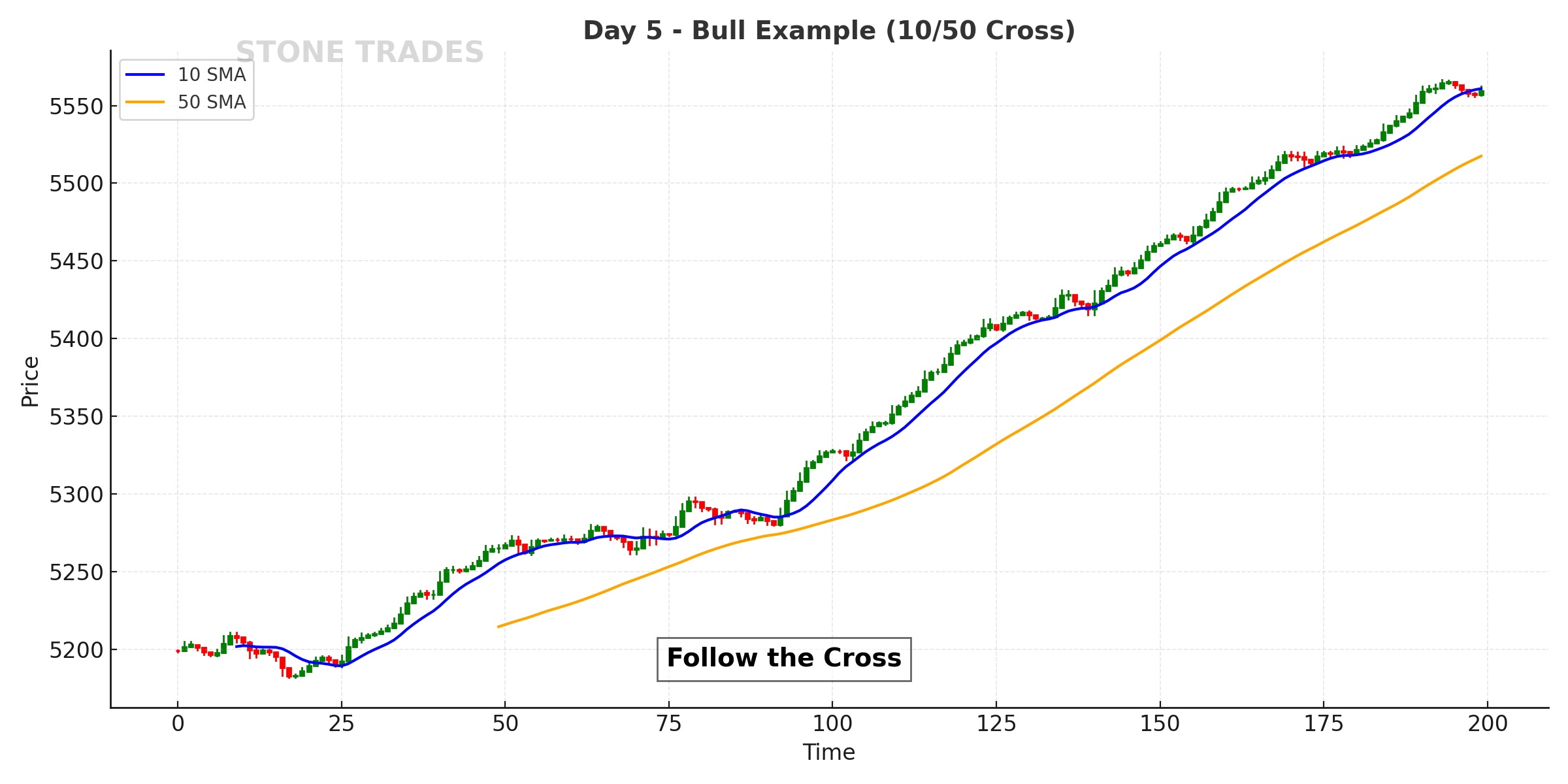

Day 5 – Follow the Cross

When the 10 crosses the 50, I don’t argue—I follow.

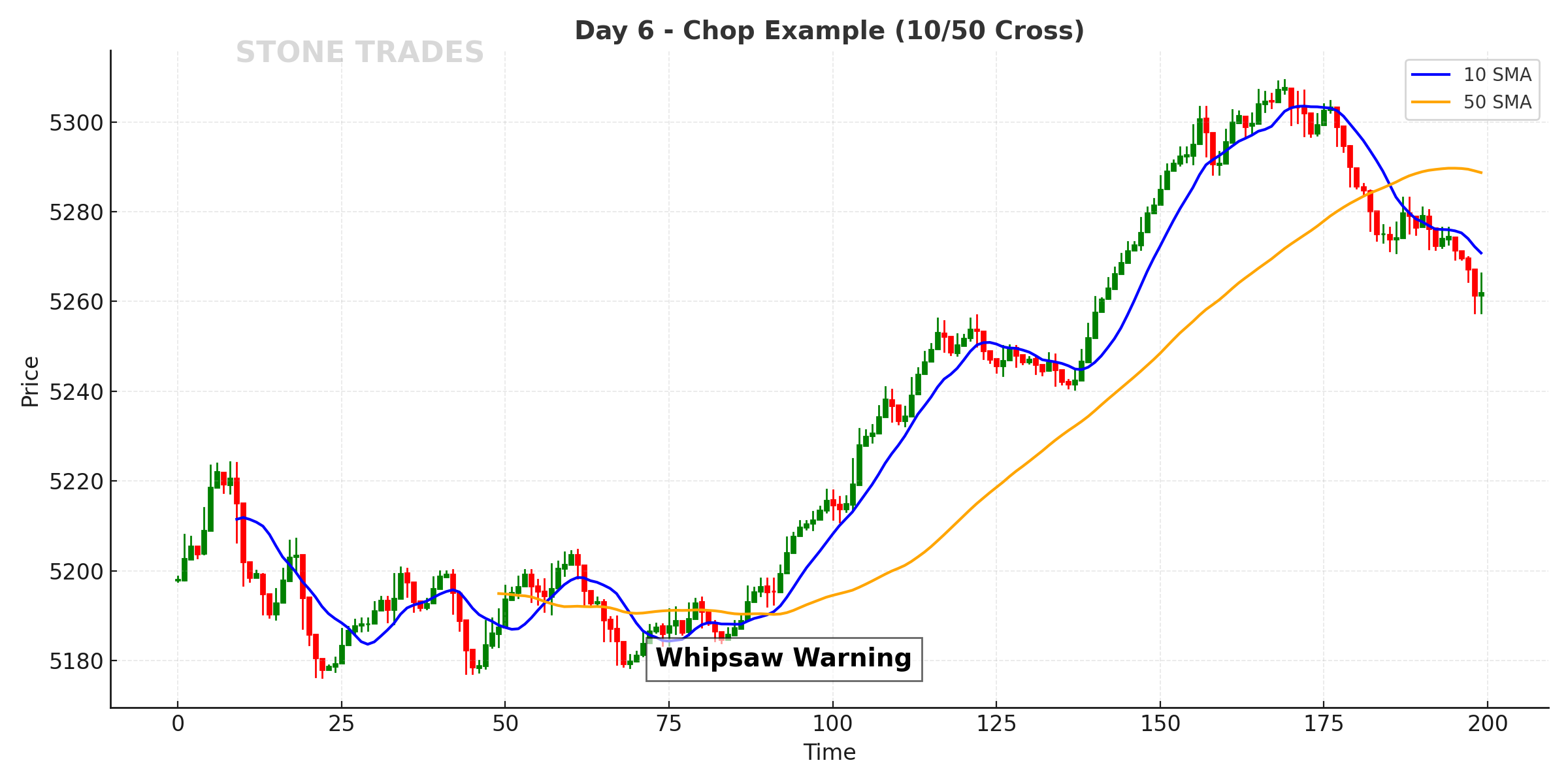

Day 6 – Trade the Open Without Chaos

First 30 minutes are a trap if you crave action—wait for the 10/50 to speak.

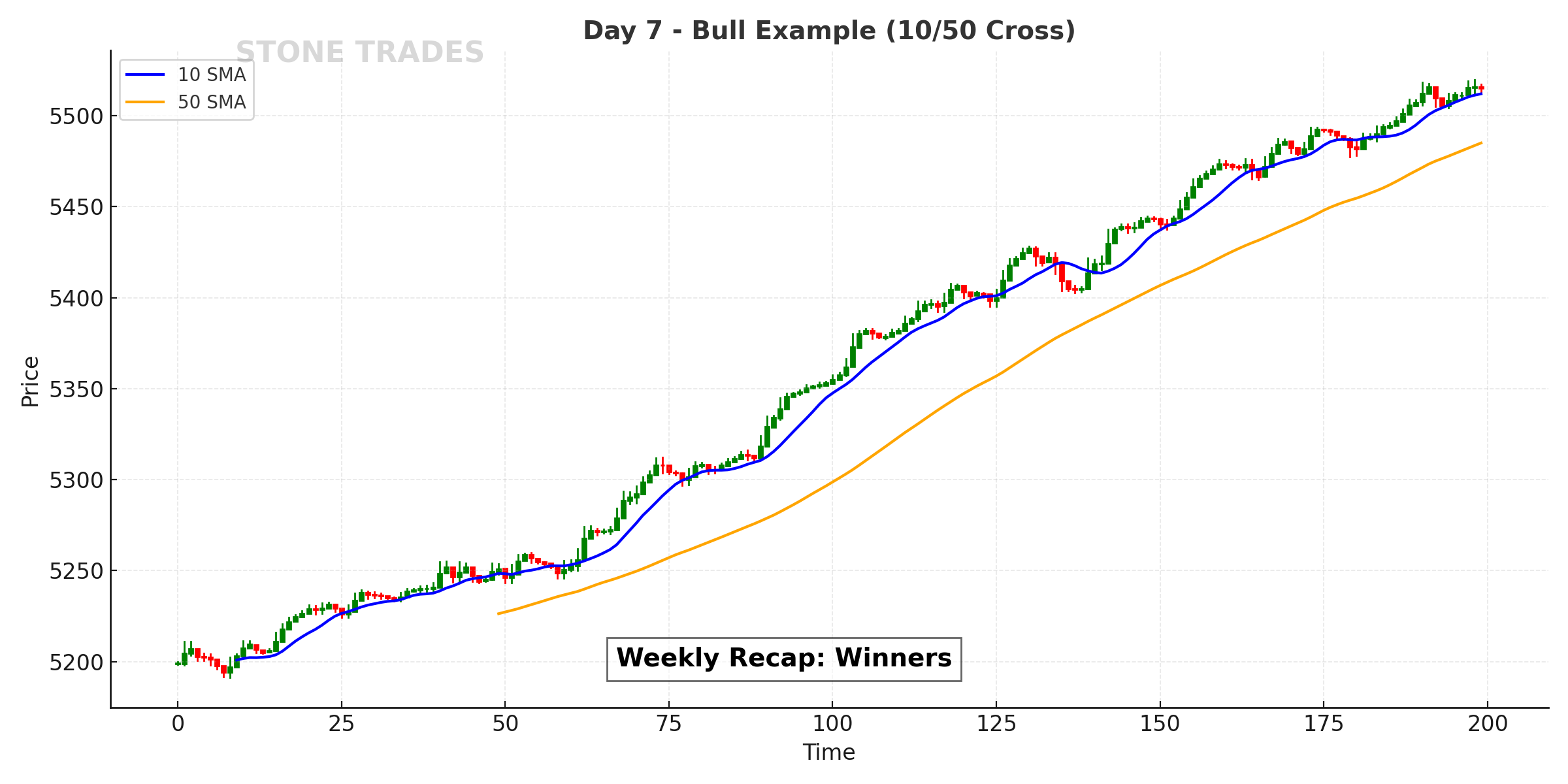

Day 7 – Weekly Recap: Win by Being Boring

A handful of clean crosses beat dozens of impulsive clicks.

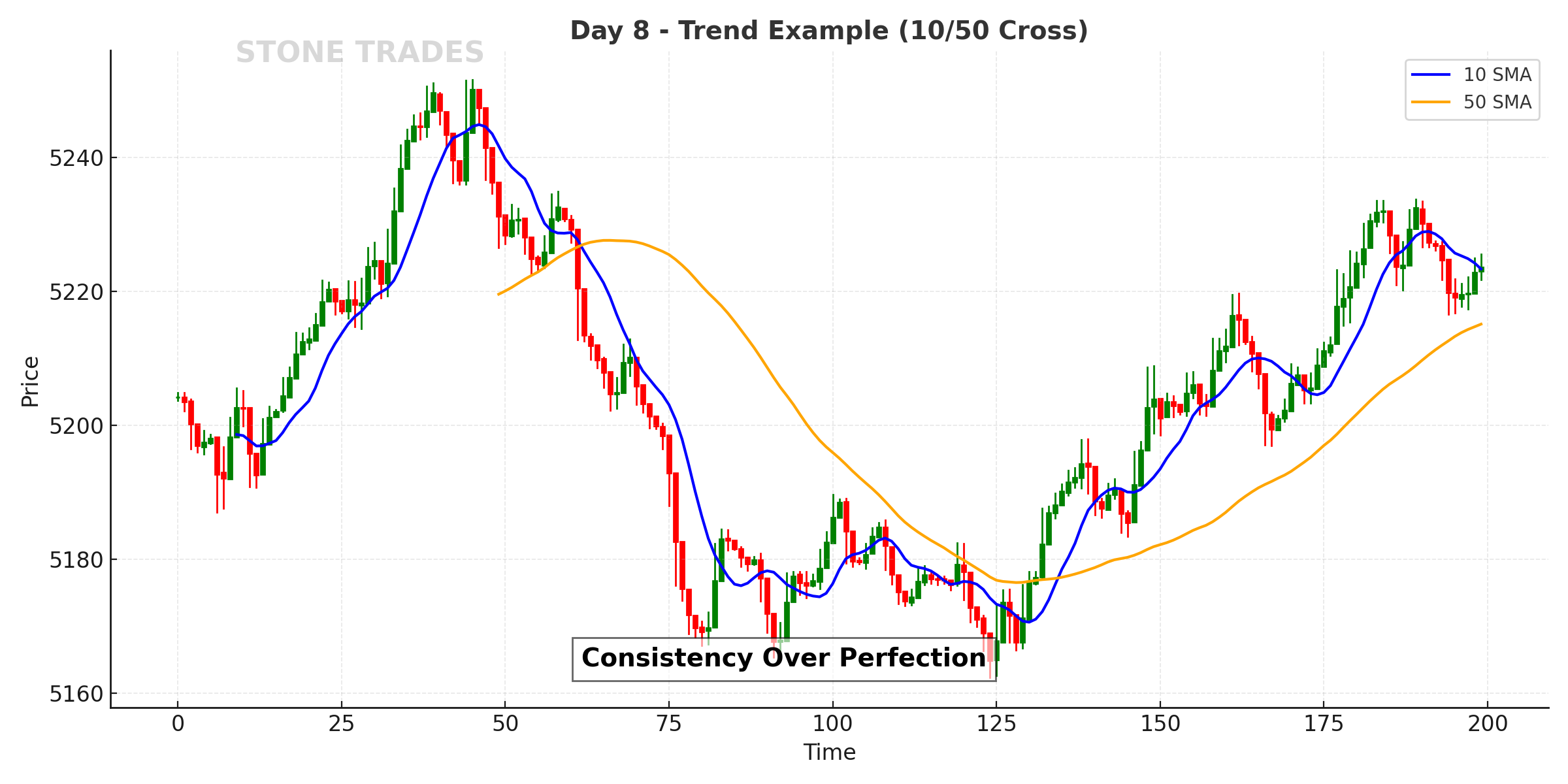

Day 8 – Consistency Over Perfection

Three wins and two scratches still print green if risk is sane.

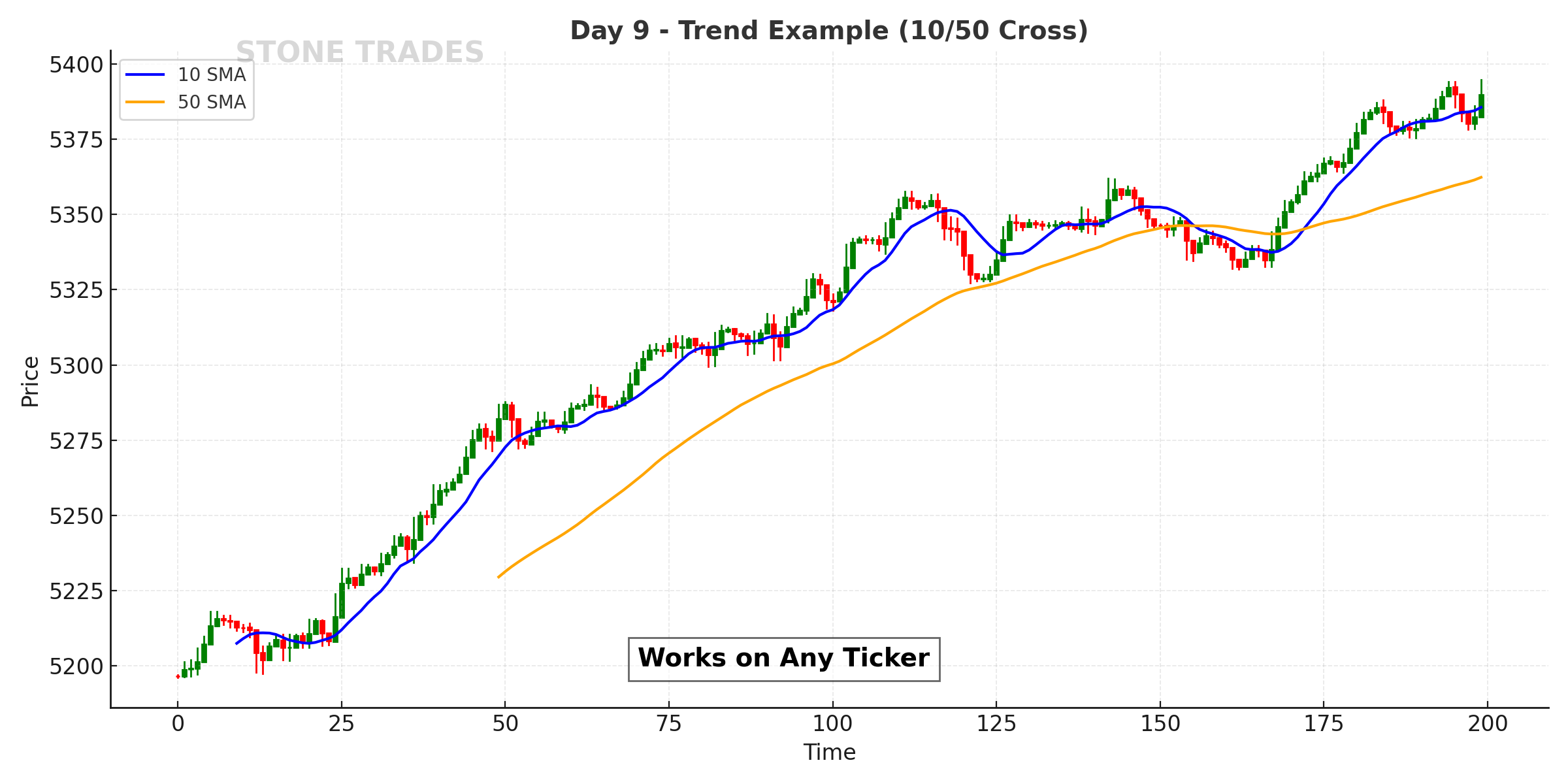

Day 9 – One System, Any Ticker

SPX, TSLA, NVDA—rules scale across symbols and sessions.

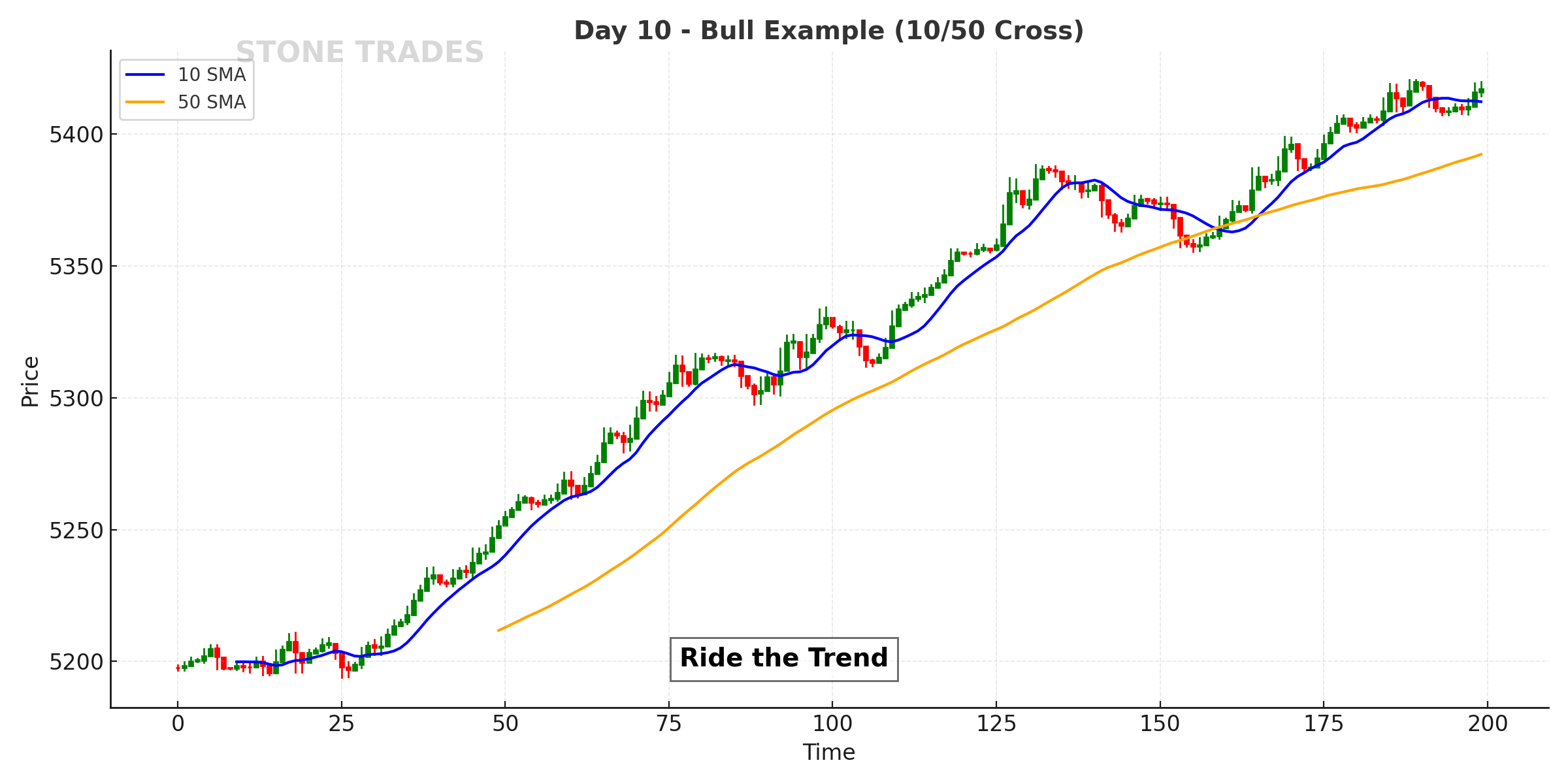

Day 10 – Ride Trends, Don’t Predict Tops

Guessing tops/bottoms is ego. Riding trends is business.

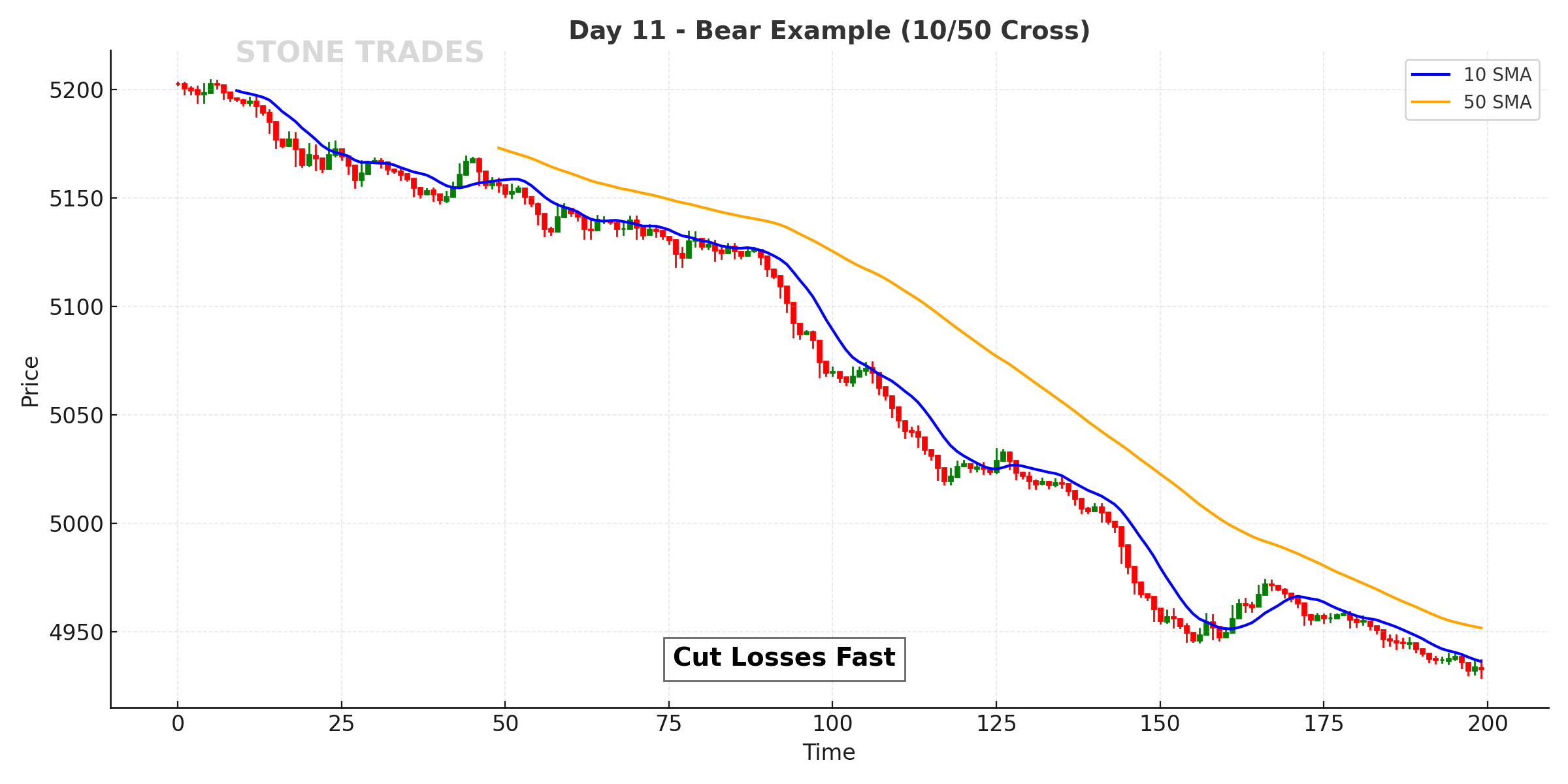

Day 11 – Cut Losses Fast

The cross can fail. Your speed in cutting is your edge.

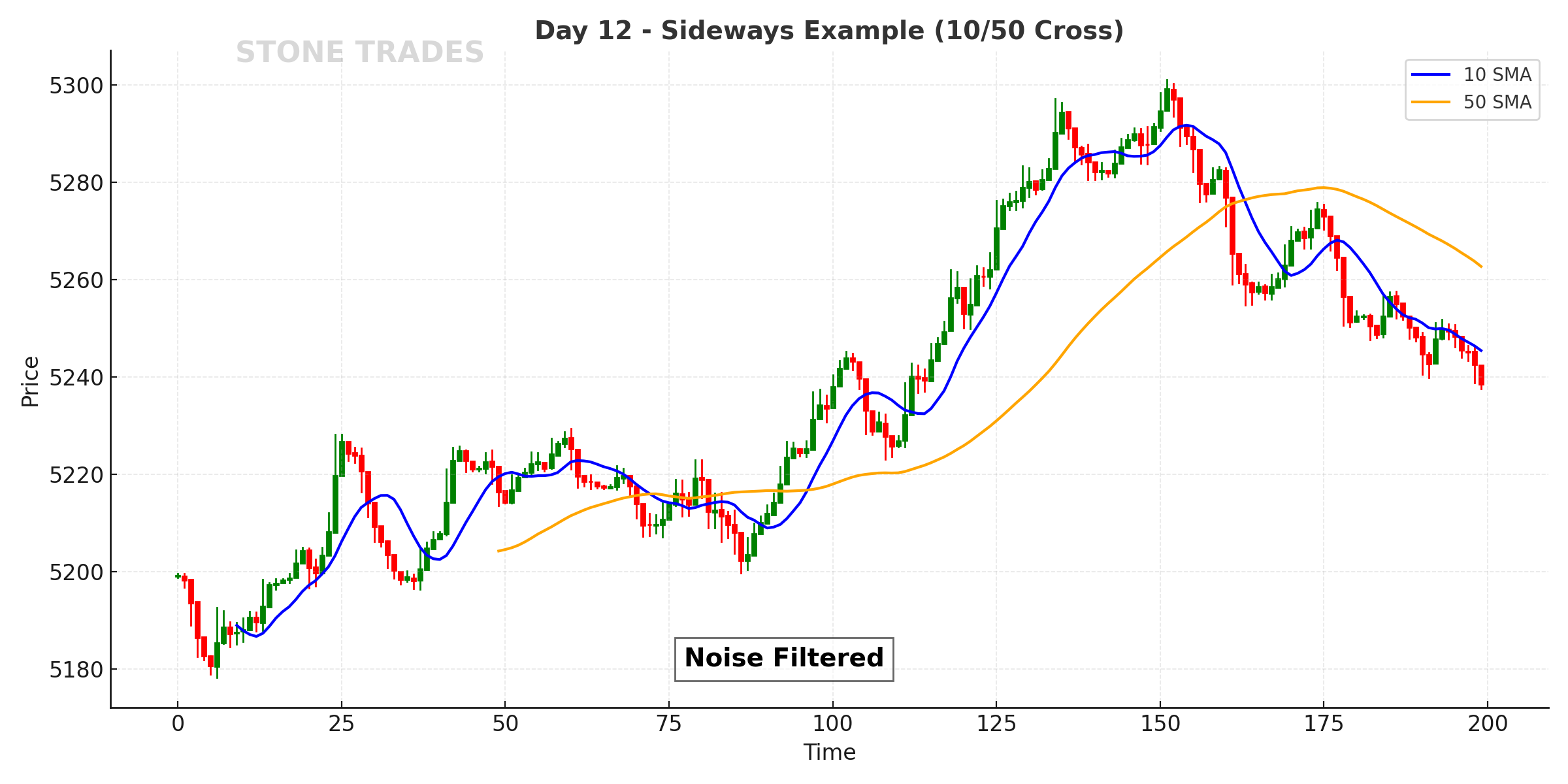

Day 12 – The 30-Minute Advantage

30-minute charts filter noise and show structure you can trust.

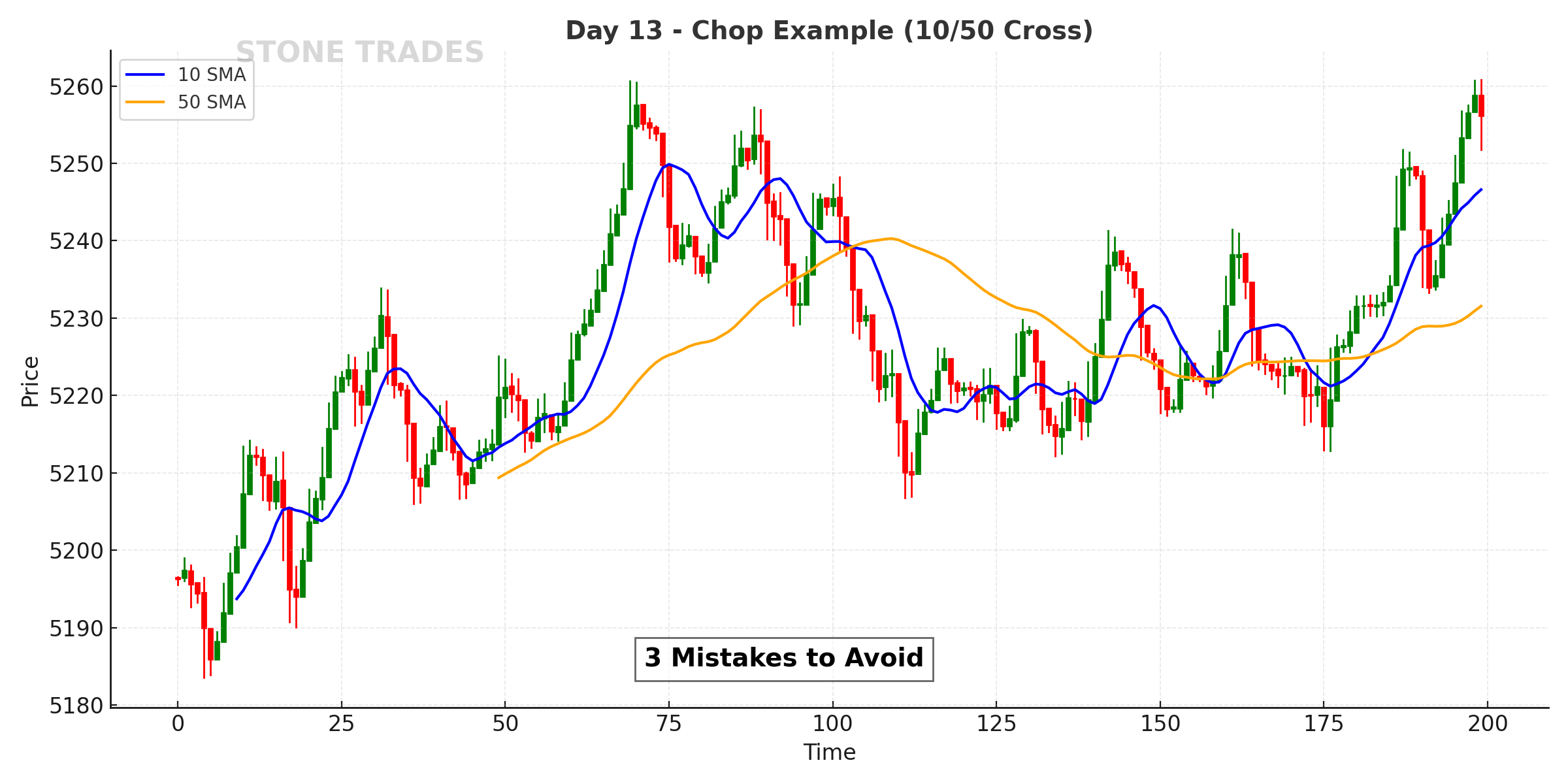

Day 13 – 3 Moving Average Mistakes

Stop tweaking, stop scalping the 1-minute, stop stacking indicators.

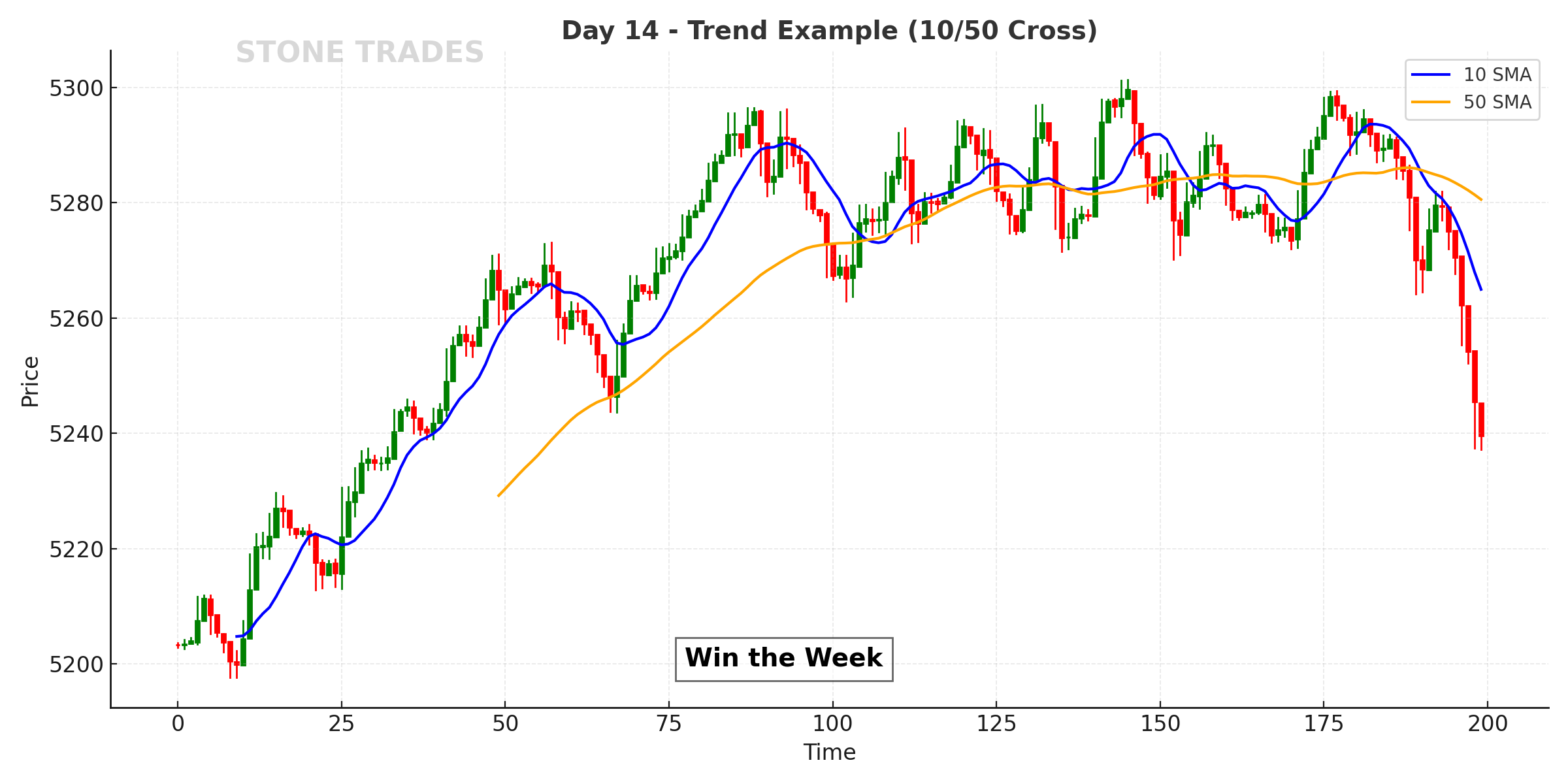

Day 14 – Win the Week

You don’t need to win every trade; you need to win the week.

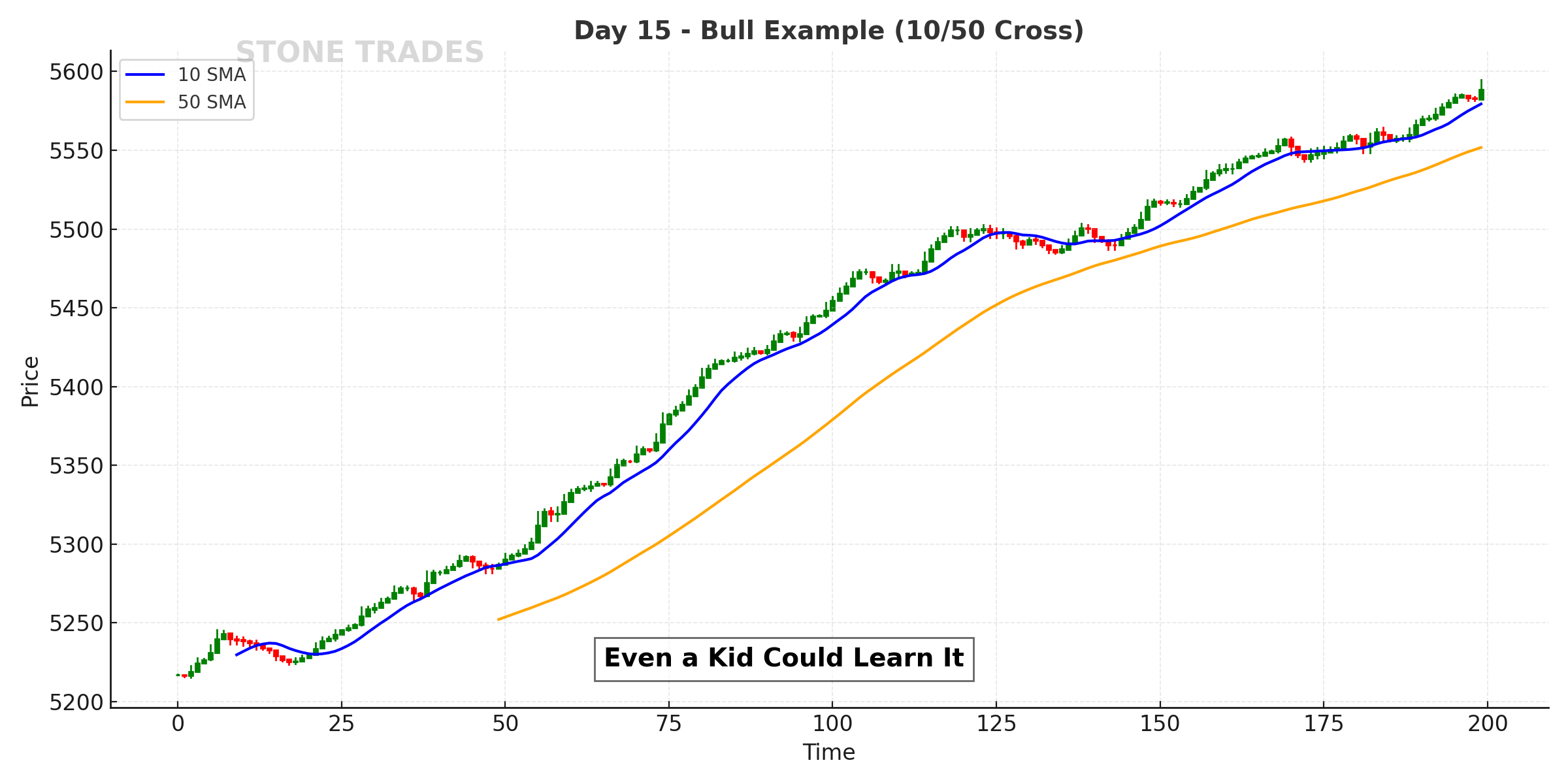

Day 15 – Teach It to a 12-Year-Old

If a kid can follow the rules, so can a pro. Simplicity scales.

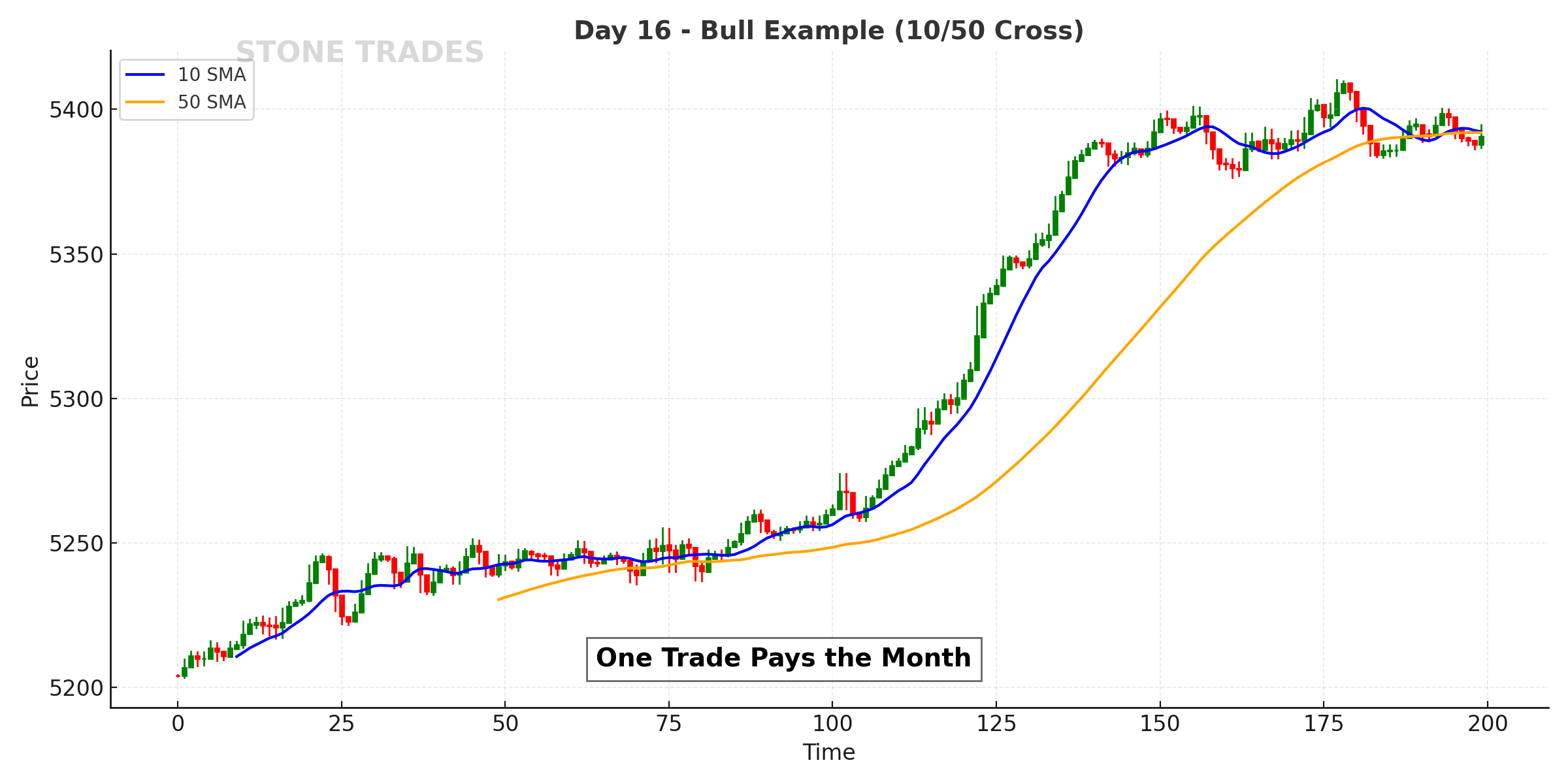

Day 16 – One Trade Can Pay the Month

You don’t need many trades—you need the right ones ridden well.

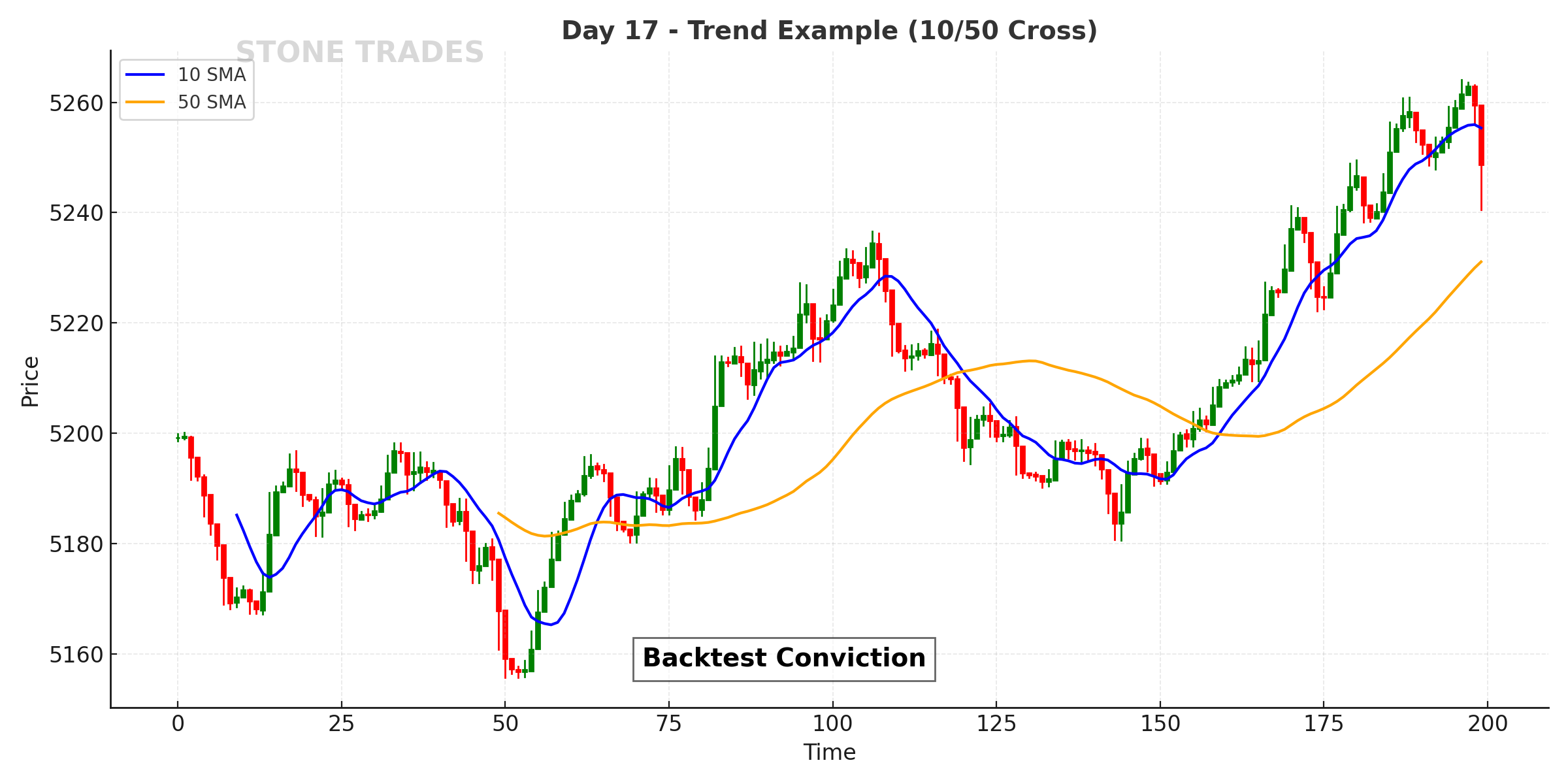

Day 17 – Backtesting Builds Conviction

If you won’t backtest, you don’t truly believe your system.

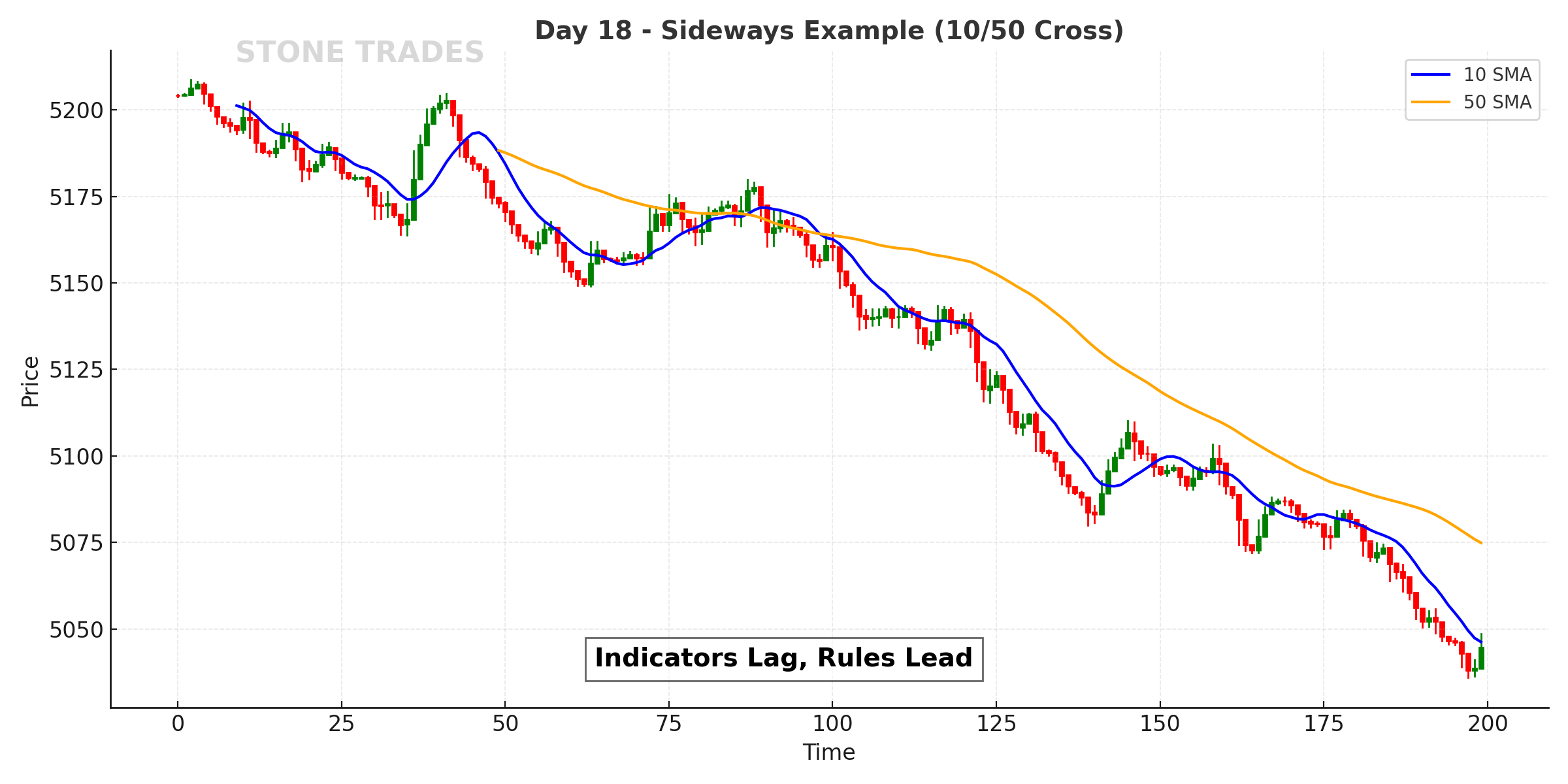

Day 18 – Indicators Lag, Rules Lead

RSI/MACD/Bands all trail price. Your rules must lead your actions.

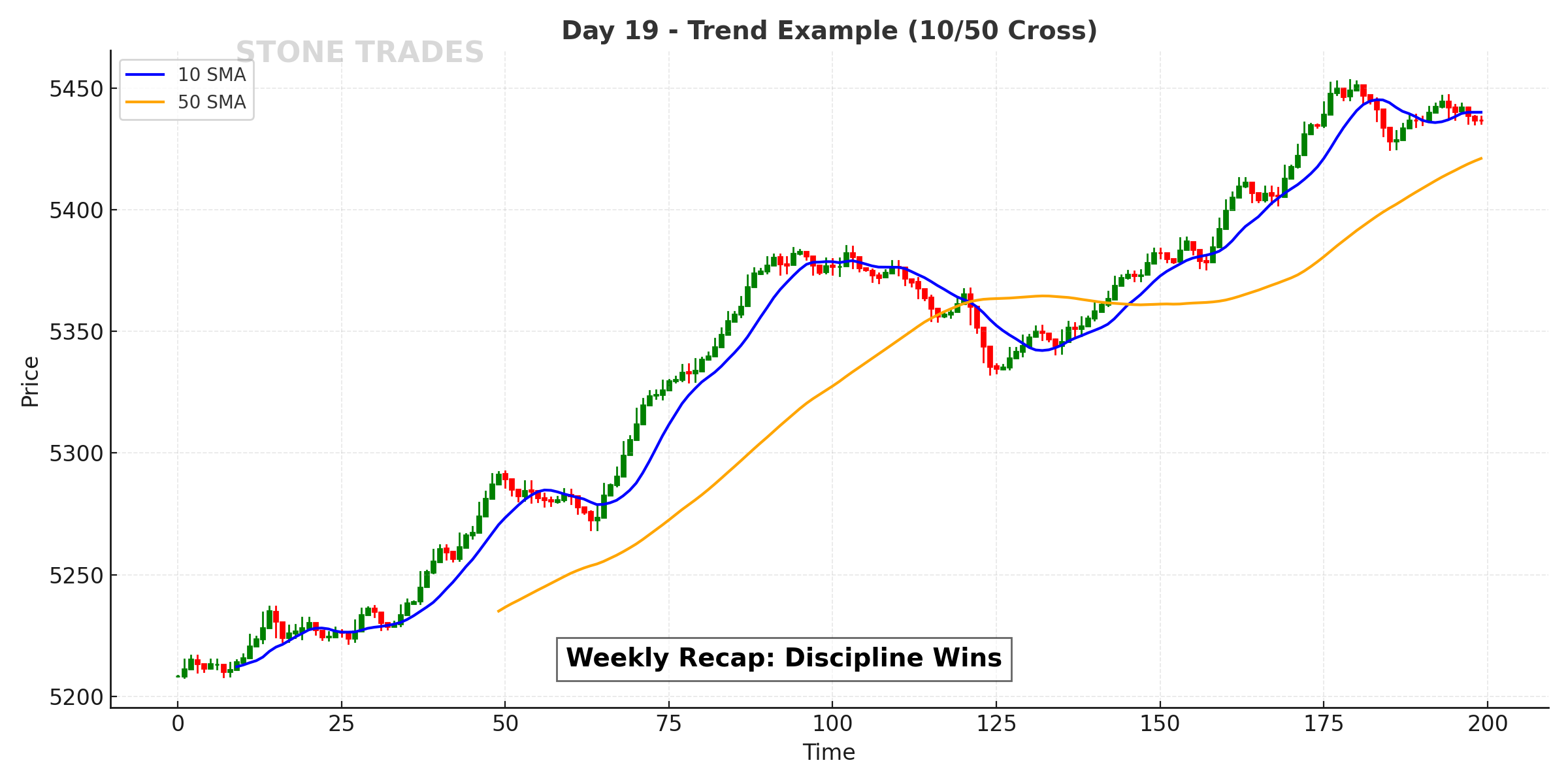

Day 19 – Discipline Wins Again

Another week, same lesson: rules beat feelings.

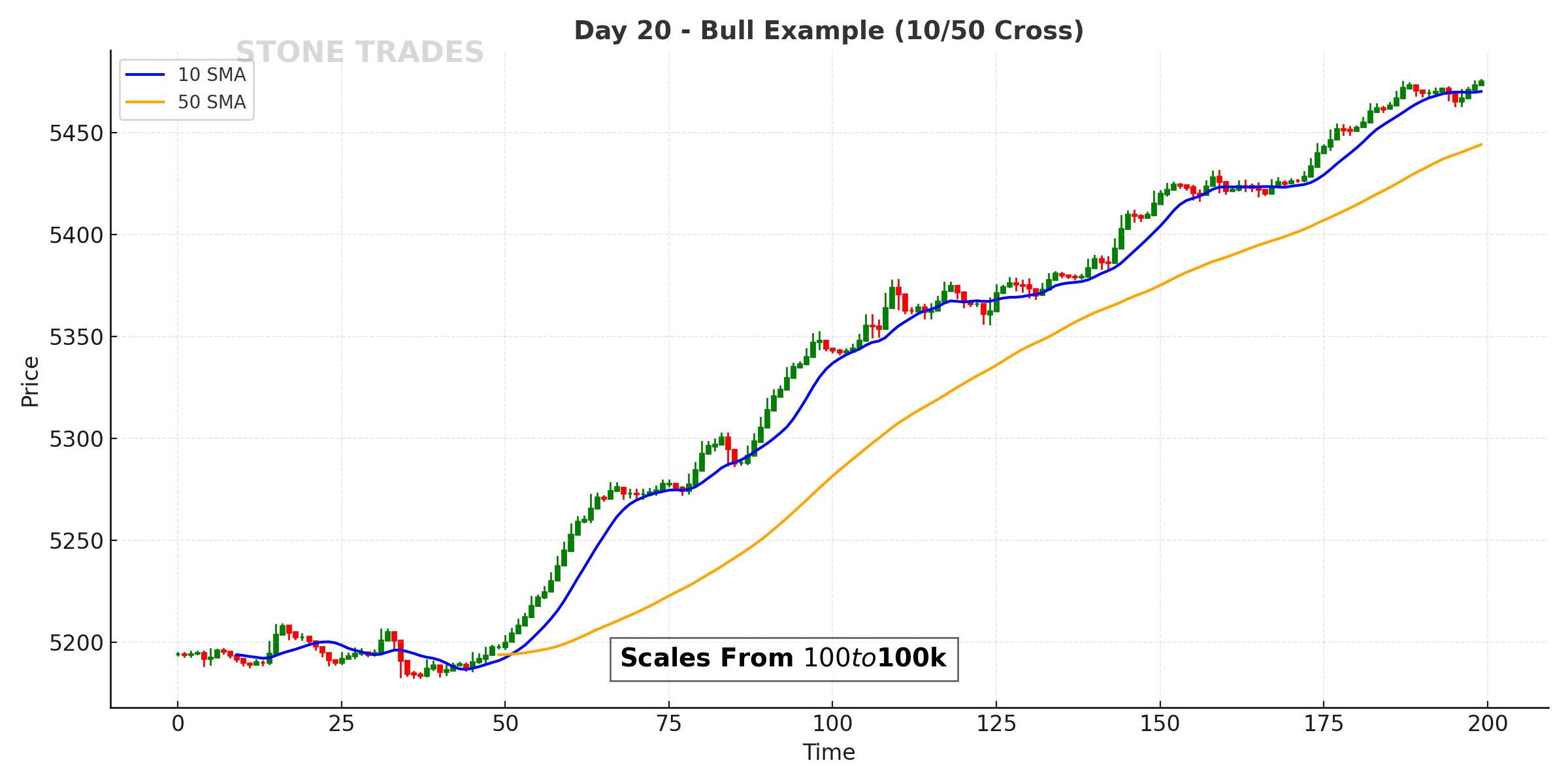

Day 20 – Same Rules, Any Account Size

The 10/50 scales from $100 to $100k because behavior scales.

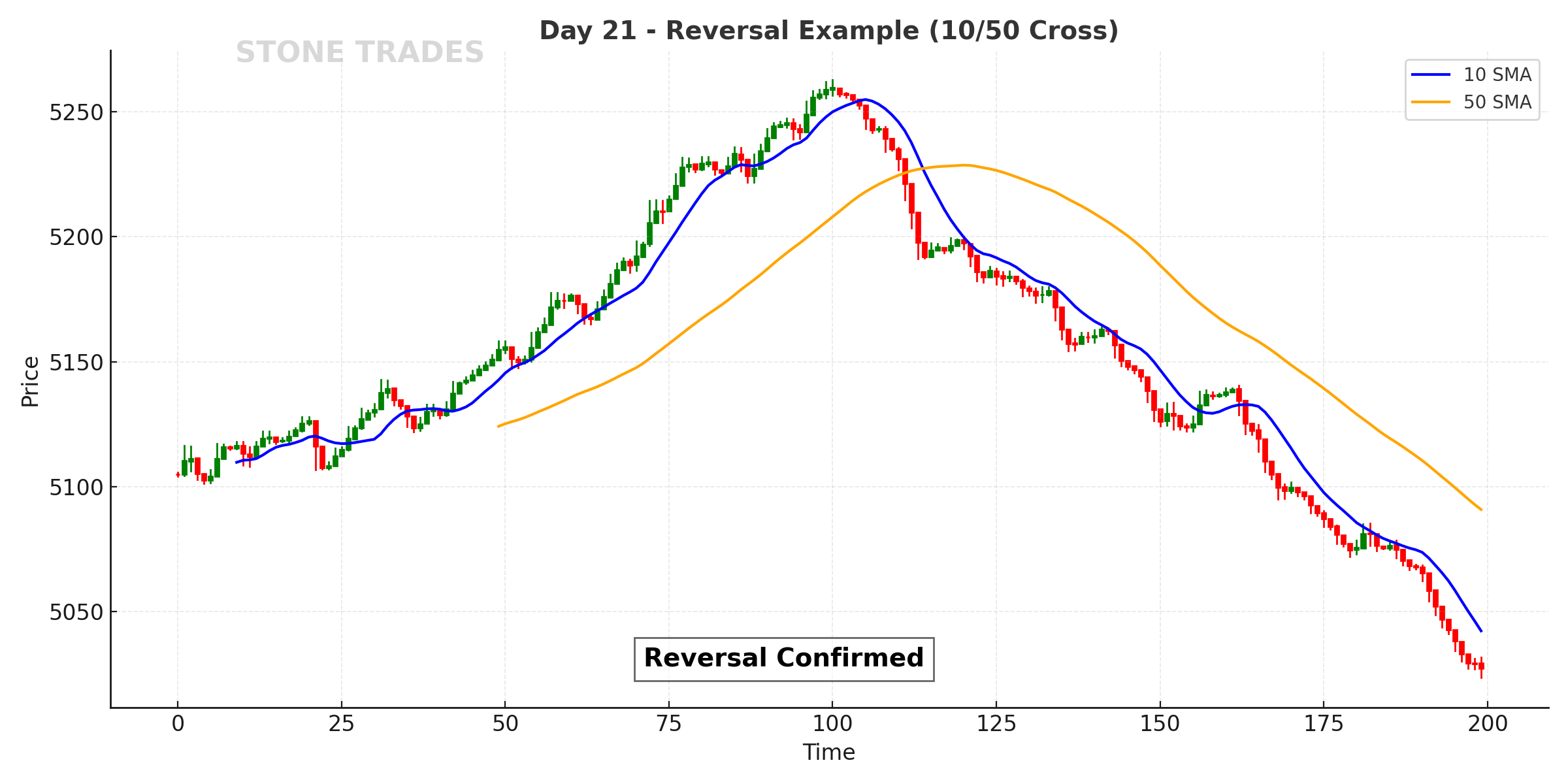

Day 21 – Reversal Confirmed

Finale: clean reversal day showing the 10/50 flipping bias with conviction.